I’ve been thinking a lot lately about kids and money.

Specifically, what should kids know about money and when should we teach them?

And do they learn mainly by watching us model good financial health and behaviors – or should there also be actual direction and instruction?

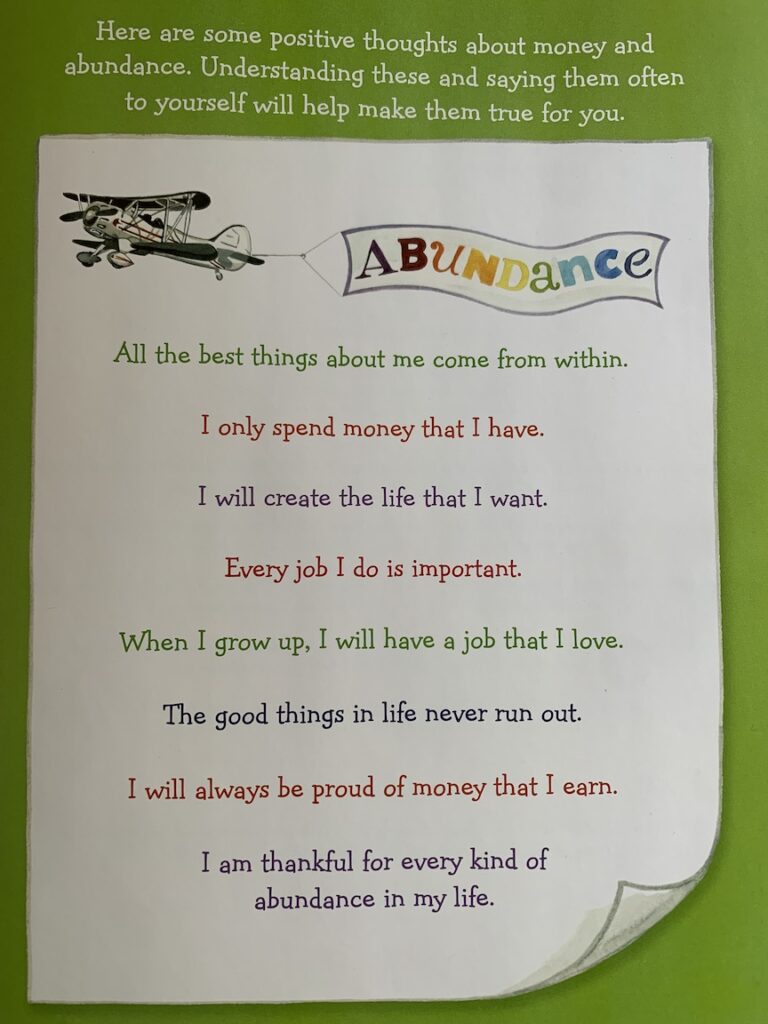

I bought a book about money for Z, called It’s Not What You’ve Got by Dr. Wayne Dyer, when she was very tiny.

I had every intention of reading it to her; I really liked it when I read it. That’s where the “Abundance” graphic to the left came from.

But every time I tried to read it to her, she would say “not that one, Mommy – it’s boring. Read a different book!” So I never got the chance to use this book for any kind of money lesson.

Instead, she has learned about money more informally and casually – but I still feel we should be doing more. I personally don’t feel that I got very good coaching or teaching about money as a kid.

I’m not sure if it’s because my parents are English and money wasn’t considered a polite topic, but there was absolutely zero family instruction in personal finance. I just had to learn on my own. I made a ton of mistakes in my 20s and 30s that I feel would have been avoidable if I’d been taught the basics of personal finance as a young person.

I took an informal poll of my friends on Facebook about when and how they learned about money and if they had any good tips to share. As always, my friends delivered! Here’s a random assortment of wonderful tips for teaching kids about money, courtesy of my Facebook circle.

- My kids have been getting money at Christmas and birthdays long before they started having jobs so I’ve been preaching wise spending and savings since 3rd or 4th grade when they could fully comprehend it. I then gave them a goal as they got into high school: they’d have to pay for their next phone themselves. So, as they worked part-time and got gift money during their sophomore and junior years, they saved up money for their expensive iPhones. Having a goal and ownership of their phones made a huge impression on them. It also resulted in them doing research on which iPhone was the best value instead of expecting me to buy them the most expensive model. Skin-in-the-game is a must for a kid to understand money and ownership.

- I grew up with two grandparents who survived The Great Depression, so learning frugality started very early in my life. When I was in grade school, lunch was 75¢ but on Fridays, you could buy chocolate milk for a quarter. So I’d ask for $1, and sometimes my mom didn’t have it to give me. So I learned early that sometimes there just isn’t money for what you want.

- When I was in high school and started getting babysitting jobs, Mom had me open a savings account. Her rule was that I had to save 30%. This continued with my first regular job. When I was 18 and got my first checking account, she taught me how to balance my checkbook, make a budget and pay bills. Credit cards were for emergencies only and she told me to never charge more than I could pay off the next month. Did I always listen to this? No! I had to learn some financial lessons the hard way.

- I think I was about 8 when mom and dad started teaching me about money, starting with saving for tae kwon do because I was already in dance. I could buy what I wanted but only if I had money to spend (obviously special occasions like holidays, or vacations were exceptions) but for example, I would go shopping with birthday money but after spending it all, if I wanted gum I was told that if I didn’t have the money I couldn’t have it. That was very disappointing in the moment but honestly impactful in a good way. I learned that if I wanted extra cash, I needed to figure out a way to earn it (i. e. volunteering to do an extra chore, or I sold lemonade with a friend once, etc) and that I should really consider if something is worth spending the money on.

- When it comes to credit cards, I don’t have a distinct memory of learning about how/when to use it but definitely remember a multitude of discussions throughout the years. I learned that a credit card shouldn’t be seen as “extra money” but as a different way to spend what you have. To this day I still treat my credit card like a debit card; I spend what I know I can afford.

- I feel my parents did an excellent job teaching me about the responsibility of money management without causing unneeded anxiety and it never felt like what I chose to buy was controlled. If they thought I was making a big purchase, they might’ve cautioned me to help make sure I considered if it was something I truly wanted. But since it was my spending money, that I had either earned or was gifted, I could spend it how I wanted. I knew that if I couldn’t afford something, that typically meant I wouldn’t get that thing until I had the means to do so. I would deem it a success based on the fact I graduated debt-free, have a paid-off car, and am steadily saving for a longer-term goal (a house!)

- Our parents started very early in elementary school by showing me how to allocate money to spending/saving/giving. Throughout childhood, we talked a lot about how to set financial goals with purpose (saving for something we wanted, donating to a cause, etc). In high school, I started chipping in for certain expenses (phone bills, gas, etc) in addition to “fun” purchases and that’s when I got my debit card. Mom and Dad helped us all gradually build up savings accounts in childhood by encouraging us to split monetary gifts and money we earned between spending and saving. The mentality of being able to defer gratification and wait to make a big purchase until I was able to afford it was the biggest benefit I’ve carried into adulthood!

Have you begun teaching your kiddos about money yet, and which lessons were the most important for you to share? I’d love to hear how it’s going in the comments below or over on Instagram or Facebook.